The place where you get ahead after college

Your university and former classmates are wellsprings of innovation. Alumshares allows you to evaluate and invest in high growth university-related companies at the click of a button. Here’s how we do it.

01 Sourcing Opportunities

We source opportunities that meet our investment standards. Our team of experts are reviewing hundreds of opportunities to identify companies that meet our investment criteria. They look for companies with strong founding teams, groundbreaking products, and demonstrable traction operating in high growth markets.

02 Purchasing Shares

Once we identify an investment opportunity we believe has attractive risk-reward characteristics, we create a legal investment vehicle and make it available on the platform to your alumni community. Investments are available to members on a first-come-first-serve basis and can be made at the push of a button.

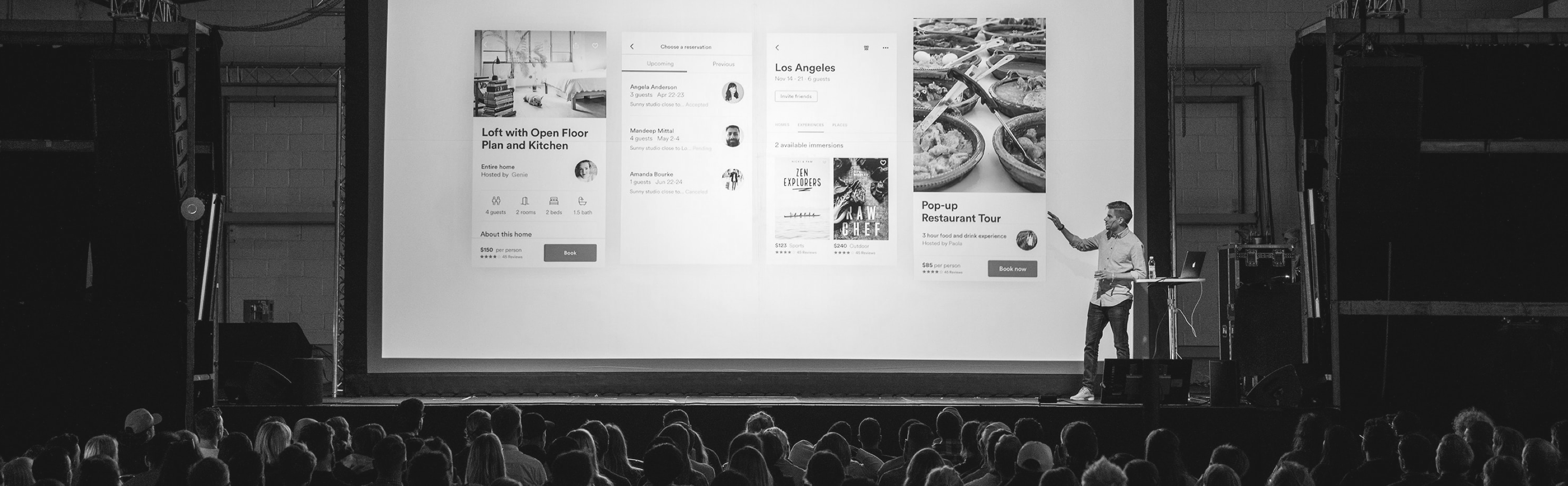

03 Tracking Investments

Purchased investments are easily tracked over the life of the investment. Upon closing of a financing round, funds are disbursed to the company and utilized by management to pursue value creation. During this period, investment progress is tracked on the platform right from your phone or desktop.

04 Realizing Returns

Investments are monetized when companies reach liquidity events. Our approach prioritizes net cash flow realized to investors and creating lasting businesses over showing short-term markups or unprofitable growth. This necessarily requires a long-term mindset and patient approach. So although a company may increase in value throughout the holding period, returns are typically only realized at the end through a liquidity event.