Invest like you donated the library

Almost anyone can access stocks and bonds these days, but pioneering portfolios also include exposure to high growth private market opportunities before they’re public. Given their scarcity, quality private market investments have typically been reserved for billion dollar institutions and the incredibly well connected.

Through the power of the network of alumni like yourself, you can now access these opportunities at minimums never seen before.

Investment Philosophy

Although we don’t make investment recommendations, we believe it is extremely important to share our guiding principles to make it clear what we stand for and the goals we aim to achieve.

Investing when it matters most

Typically, your first chance to invest comes when a company goes public. However, by then a large portion of profit has already been realized. We focus on opportunities where precursors to success have been achieved but significant value creation lies ahead.

Supercharge your portfolio

For years, institutional investors have outperformed public markets by investing in alternative assets like venture capital. Now you too can give your portfolio the edge. Whether you’re a newcomer or an expert, accessing alternative assets, tracking your positions, and diversifying your investment portfolio has never been easier.

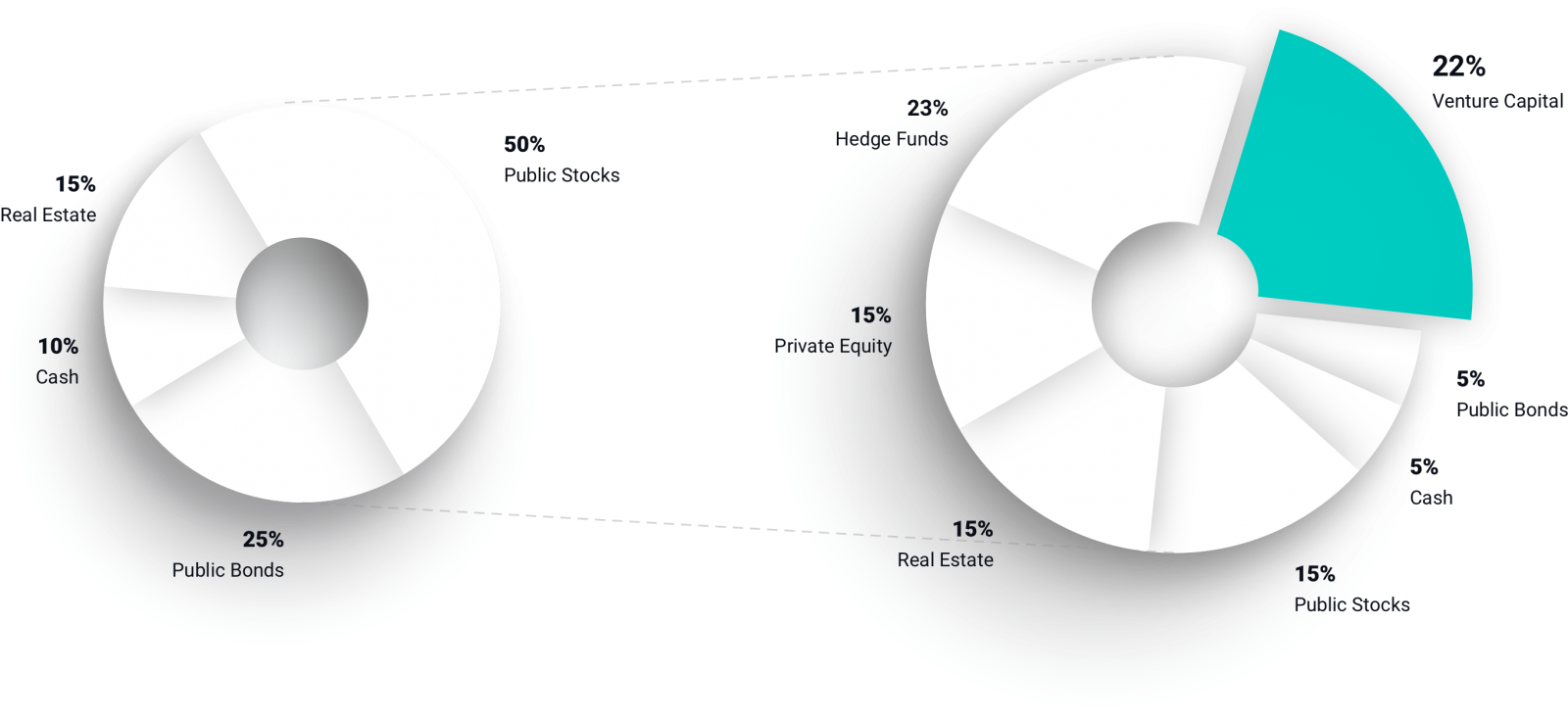

Typical Investment Portfolio

Most traditional portfolios consist of a highly correlated group of asset classes typically including publicly traded stocks, publicly traded bonds, cash, and some real estate.

Yale Endowment Model

The Yale Endowment has consistently beat the market through allocating a portion of their portfolio towards alternative assets including venture capital, private equity, and hedge funds.